In finance, the numbers do the talking – but when it comes to landing your next role, it’s your CV that needs to speak volumes. Financial Controller positions are competitive and rewarding – so you’ll need a CV that reflects your ability to drive growth, and maintain rock-solid financial oversight.

This guide (with a Financial Controller CV example) will help you build a clear, results-driven CV that highlights your commercial impact and ability to lead from the ledger, all with the aim of landing you the jobs you’re after.

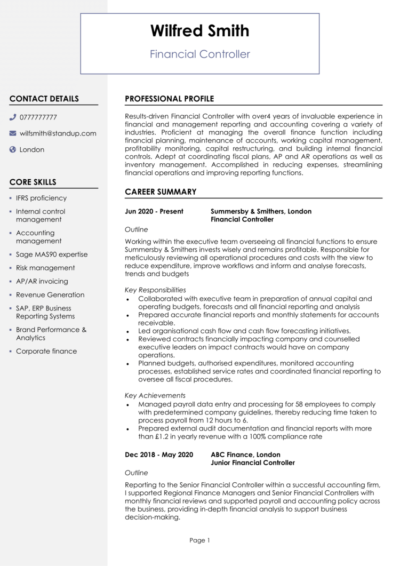

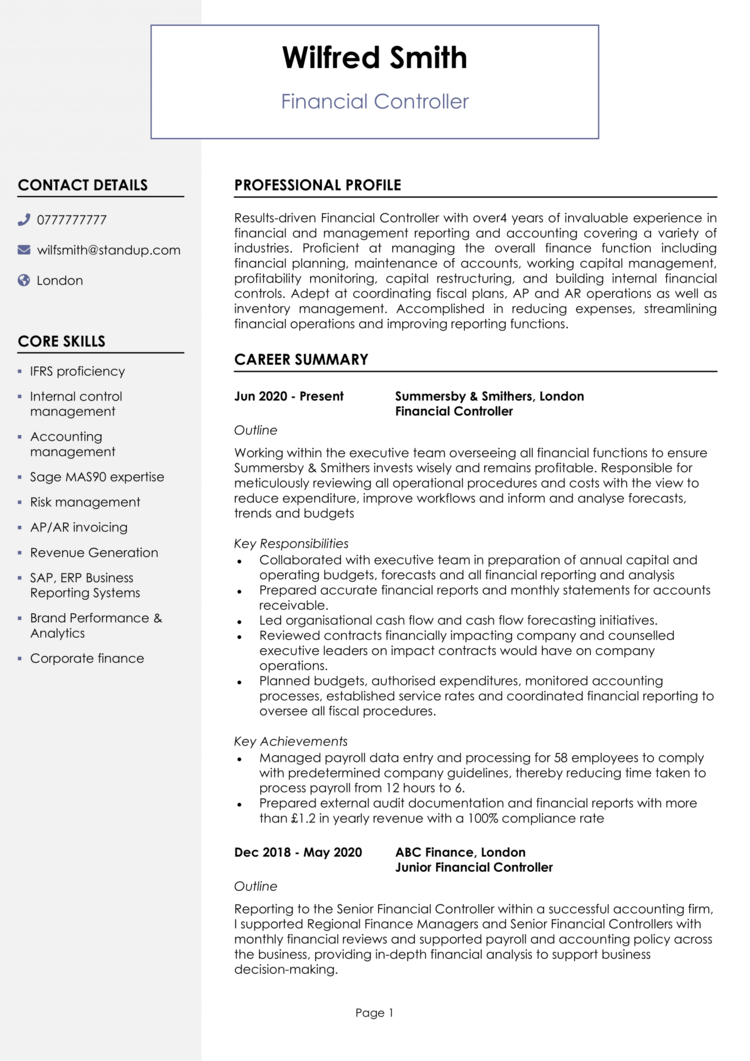

Financial Controller CV

How to write your Financial Controller CV

Discover how to craft a winning Financial Controller CV that lands interviews with this simple step-by-step guide.

Financial Controllers are responsible for more than spreadsheets – they play a critical role in guiding strategy, ensuring compliance, and supporting decision-making across the business. Your CV should reflect this influence and responsibility at every stage.

In the sections ahead, we’ll show you how to write your CV with your qualifications and financial expertise in a way that positions you as a trusted expert and a valuable senior team member.

How should you structure and format a Financial Controller CV?

As a finance leader, you already know that structure underpins success – and your CV is no exception. A well-organised, easy-to-follow layout gives hiring managers confidence in your ability to communicate clearly, prioritise effectively, and manage information professionally.

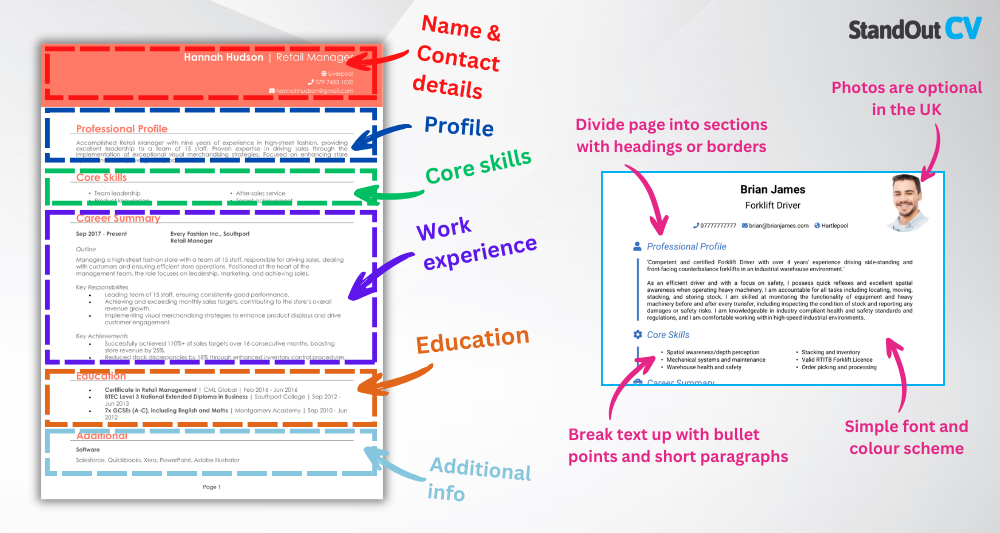

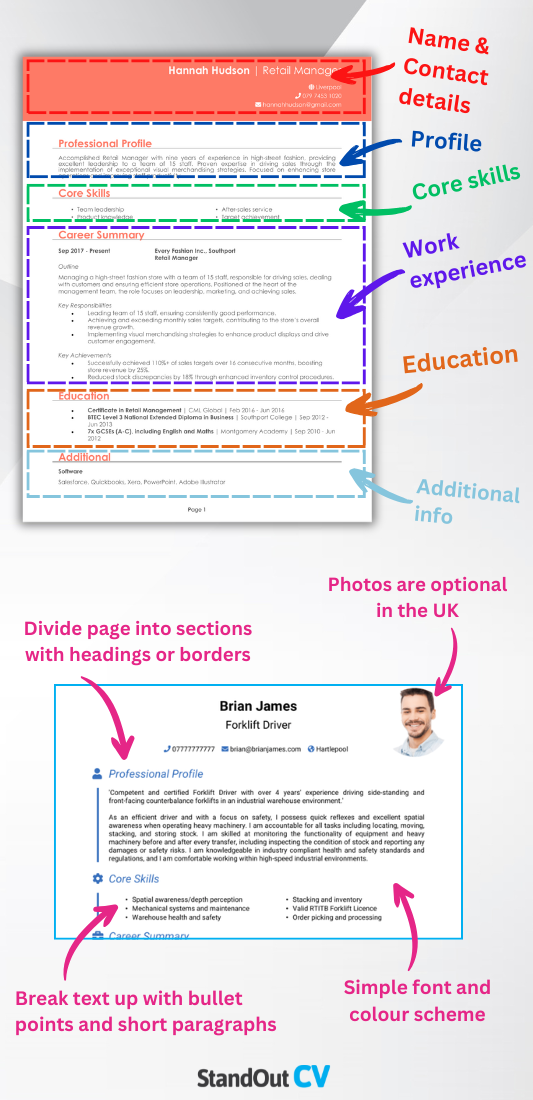

Here’s the layout to follow:

- Name and contact details – Place your name and personal info prominently at the top of your CV for quick access. Adding a photo is up to you.

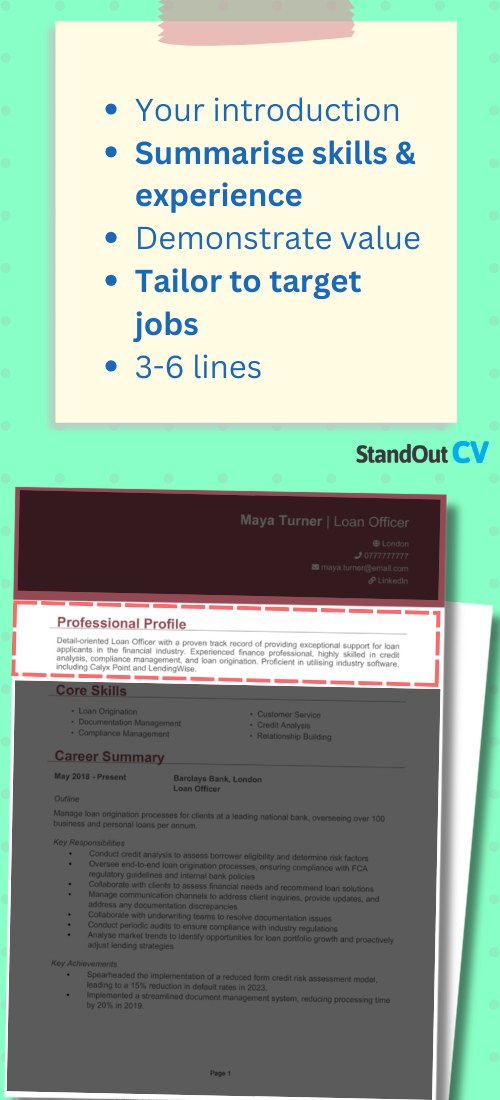

- Profile – A brief introduction summarising your finance leadership and sector expertise.

- Core skills – Use bullet points to highlight key competencies aligned with the role.

- Work experience – Start with your most recent roles and work backward.

- Education & certifications – Include your degrees, professional qualifications, and any specialist finance training.

- Additional info – Optionally include awards, hobbies, languages, or professional memberships.

Use bullet points to break up dense content, apply a clean and readable font, clearly divide each section, and keep the document within two pages of length. Professional CV formatting shows you know how to present complex information clearly and with purpose – an essential skill for any Financial Controller. Attention to detail matters just as much on your CV as it does in your reporting, so ensure consistency in layout, alignment, and style throughout.

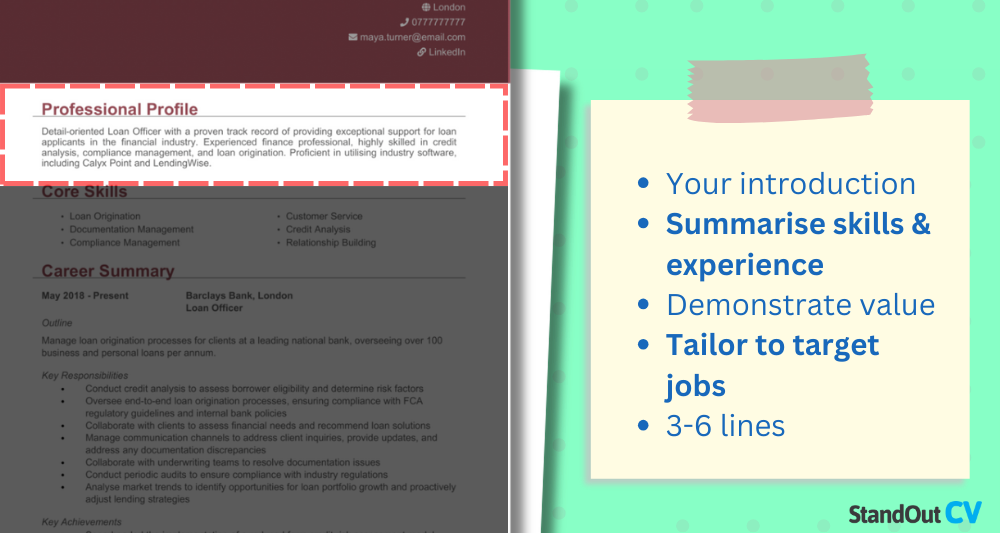

Writing a Financial Controller CV profile

Your profile sets the tone for the rest of your application. As a Financial Controller, this is your chance to show that you’re not just a finance expert – you’re a commercial leader who drives results, ensures compliance, and builds strong cross-functional partnerships. This short section should give recruiters confidence in your ability to manage budgets, improve processes, and contribute meaningfully to strategic decisions at board level.

Financial Controller CV profile examples

Profile 1

Experienced Financial Controller with over seven years of experience overseeing financial operations for mid-sized companies in the manufacturing and logistics sectors. Skilled in budgeting, forecasting, and financial reporting, with a strong command of compliance and regulatory requirements. Proficient in SAP, QuickBooks, and Excel. Known for delivering actionable insights and driving process improvements to enhance financial performance.

Profile 2

Detail-oriented Financial Controller with six years of experience managing end-to-end finance functions within high-growth SMEs. Adept at cash flow management, cost analysis, and leading month-end close processes. Experienced in managing teams and collaborating with external auditors. Strong technical knowledge combined with a commercial mindset to support strategic decision-making.

Profile 3

Strategic Financial Controller with eight years of experience in corporate finance, including experience in multinational environments. Expertise in financial planning and analysis, internal controls, and multi-entity consolidation. Proficient in Oracle and Power BI. Proven track record of improving reporting accuracy, streamlining systems, and supporting executive leadership with high-level financial insights.

Details to put in your Financial Controller CV profile

Here’s what to include:

- Where you’ve worked – Mention industries, company sizes, and regions you’ve supported (e.g. SMEs, multinational corporations, or listed companies).

- Your top qualifications – List relevant credentials such as ACA, ACCA, CIMA, or a master’s in finance.

- Essential skills – Refer to your strategic planning, compliance management, or leadership experience.

- Experience managing teams or departments – Show that you’ve led finance functions or supported senior decision-makers.

- Contribution to financial improvement or transformation – Highlight successes in cost-saving, restructuring, or system implementation.

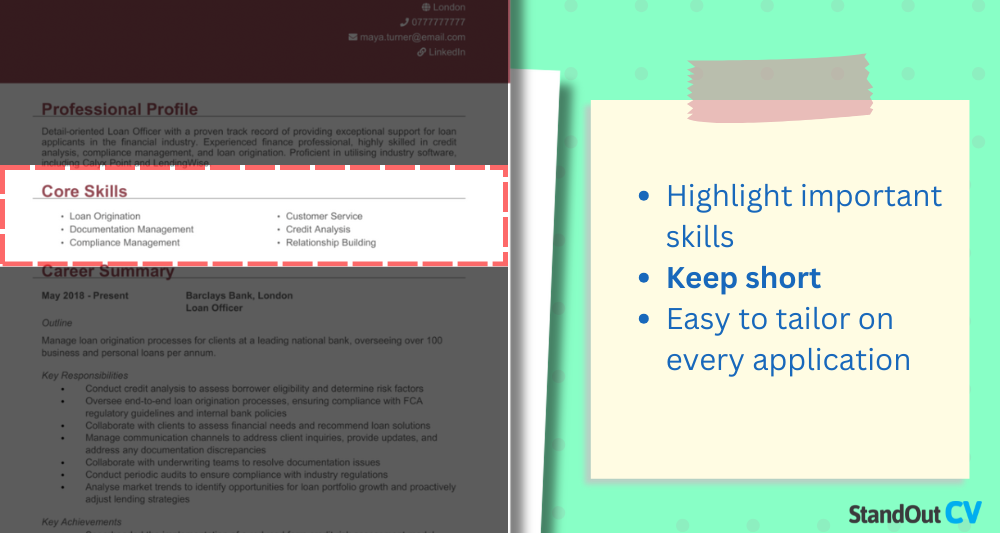

Writing an effective core skills section

Your CV skills section is your chance to give recruiters a quick overview of your most valuable strengths. But rather than listing every financial buzzword, focus on providing a high-level impression of the way you operate as a finance leader.

Tailor your skills to the organisation’s needs. Consider how you approach risk, compliance, automation, and commercial finance, and include the keywords recruiters are actively looking for when they open up any application.

The top skills to highlight in your Financial Controller CV

- Financial Reporting and Analysis – Preparing accurate financial statements, management reports, and forecasts to support strategic decisions.

- Budgeting and Forecasting – Leading the budgeting process and providing financial projections aligned with company goals.

- Cash Flow Management – Monitoring inflows and outflows to ensure liquidity, optimise working capital, and support business operations.

- Regulatory Compliance and Audit Management – Ensuring adherence to tax laws, accounting standards (e.g. IFRS, GAAP), and coordinating external audits.

- Team Leadership and Development – Managing and mentoring finance staff, fostering a high-performing finance team.

- Internal Controls and Risk Management – Developing policies to safeguard assets, prevent fraud, and enhance operational efficiency.

- Variance Analysis – Identifying deviations between actual and budgeted figures and recommending corrective actions.

- ERP and Financial Systems Management – Overseeing the use of systems such as SAP, Oracle, or NetSuite to streamline finance operations.

- Cost Control and Profitability Analysis – Monitoring departmental costs, evaluating margins, and driving cost-saving initiatives.

- Stakeholder Reporting and Strategic Input – Presenting financial insights to senior leadership and contributing to business planning.

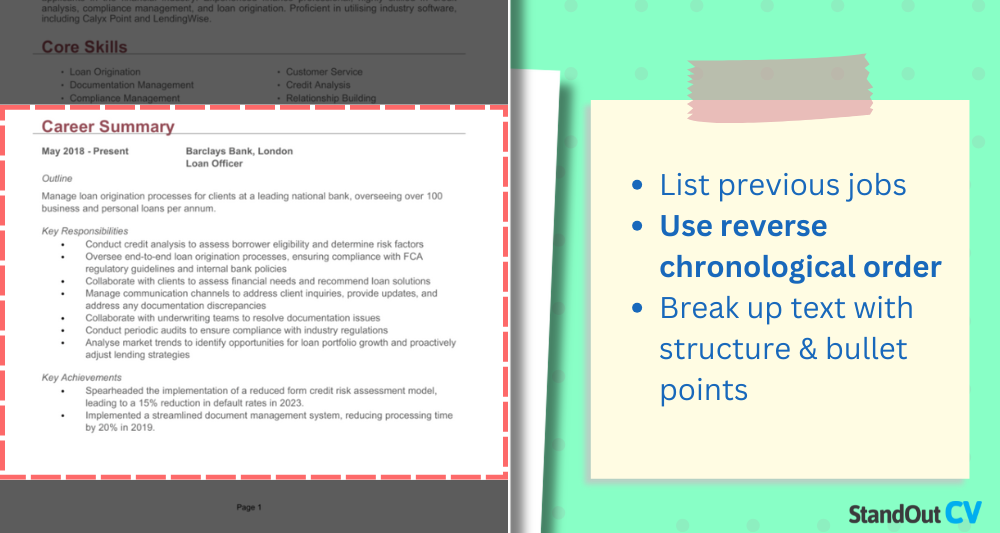

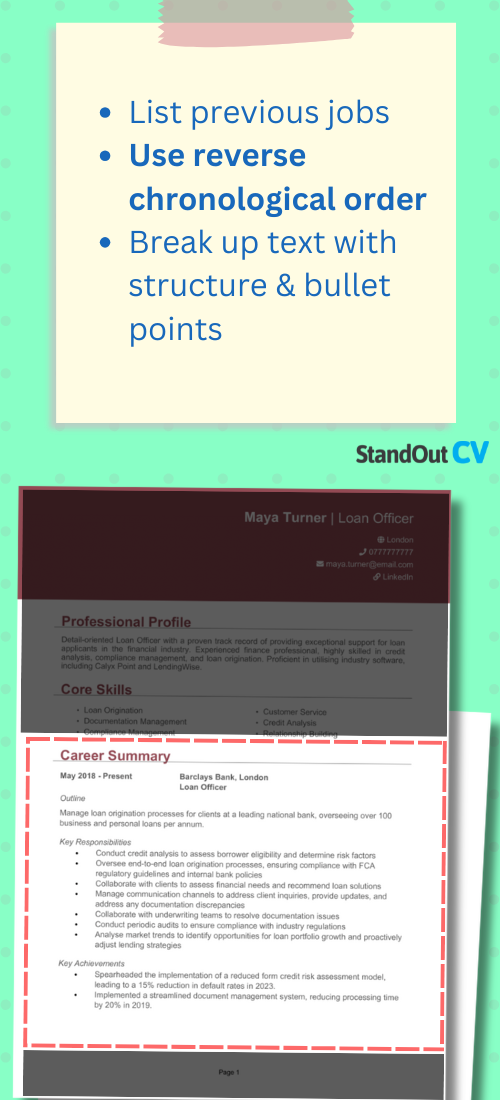

Showcasing your work experience

Your work experience section where you prove that you’re not just capable – you’ve done it before. Focus on leadership and impact, not just month-end routines or process handling. Show how you’ve delivered measurable improvements, managed people and systems, and supported wider business goals.

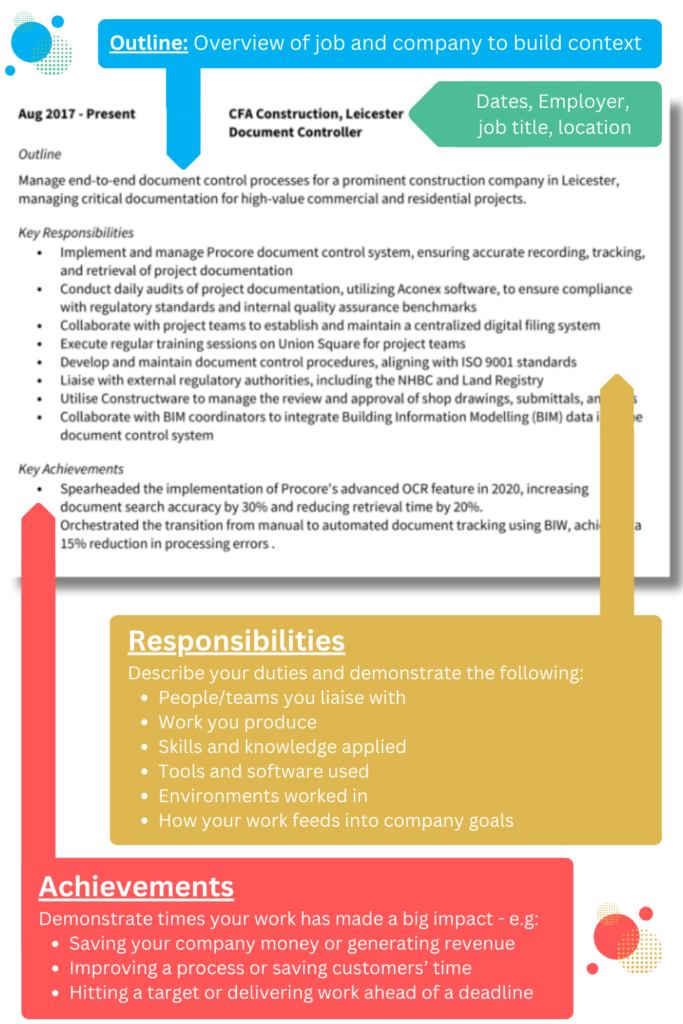

List your jobs in reverse order, with your most recent role first. Include company name, job title, and dates, followed by bullet points outlining your responsibilities and achievements. Highlight financial results, efficiency gains, transformation projects, or improvements in controls and reporting.

Writing job descriptions for past roles

- Outline – Summarise the company, the finance team structure, and your position within it.

- Responsibilities – Use action words like “led,” “implemented,” “streamlined,” or “advised.”

- Achievements – Include quantifiable results like “reduced operational costs by 18%,”, “introduced new reporting processes,” or “supported merger integration across EMEA region.”

How to present past roles for Financial Controllers

Financial Controller | Vantage Manufacturing Ltd

Outline

Managed financial operations for a national manufacturing company, overseeing reporting, budgeting, and internal controls across multiple production sites.

Responsibilities

- Prepared monthly management accounts, variance analysis, and cash flow forecasts.

- Led budgeting and forecasting processes, collaborating with department heads.

- Implemented internal control systems to improve financial accuracy and reduce risk.

- Supervised a finance team of four and coordinated with external auditors.

- Monitored capital expenditure and supported strategic investment planning.

Achievements

- Reduced month-end reporting time by 30% through automation of key processes.

- Identified cost-saving opportunities that lowered overheads by £100K annually.

- Successfully supported ERP system migration with minimal disruption to reporting cycles.

Financial Controller | Northbay Retail Group

Outline

Oversaw financial operations for a multi-site retail business, supporting board-level reporting and driving financial efficiency across the group.

Responsibilities

- Produced consolidated financial statements and liaised with external accountants.

- Managed tax compliance, including VAT returns and year-end statutory accounts.

- Introduced KPI dashboards to improve financial visibility across the business.

- Reviewed supplier contracts and monitored working capital requirements.

- Provided financial analysis to support pricing, promotions, and stock decisions.

Achievements

- Helped increase gross margin by 12% through improved cost tracking and vendor management.

- Streamlined reporting processes, reducing errors and improving accuracy.

- Recognised by the CFO for consistently delivering timely and actionable insights.

Financial Controller | Techrise Solutions Ltd

Outline

Directed all financial activities for a growing SaaS company, including planning, analysis, and financial strategy to support scale-up operations.

Responsibilities

- Prepared board packs and investor reports to support funding rounds and strategic reviews.

- Managed payroll, accounts payable/receivable, and monthly close procedures.

- Analysed revenue streams and customer churn to inform business growth strategy.

- Worked with legal and compliance teams on financial risk assessments.

- Led the implementation of new accounting software to improve reporting efficiency.

Achievements

- Supported Series B funding round by preparing detailed financial projections and due diligence packs.

- Improved forecasting accuracy by 25% through enhanced data modelling techniques.

- Reduced debtor days from 45 to 30 through improved credit control procedures.

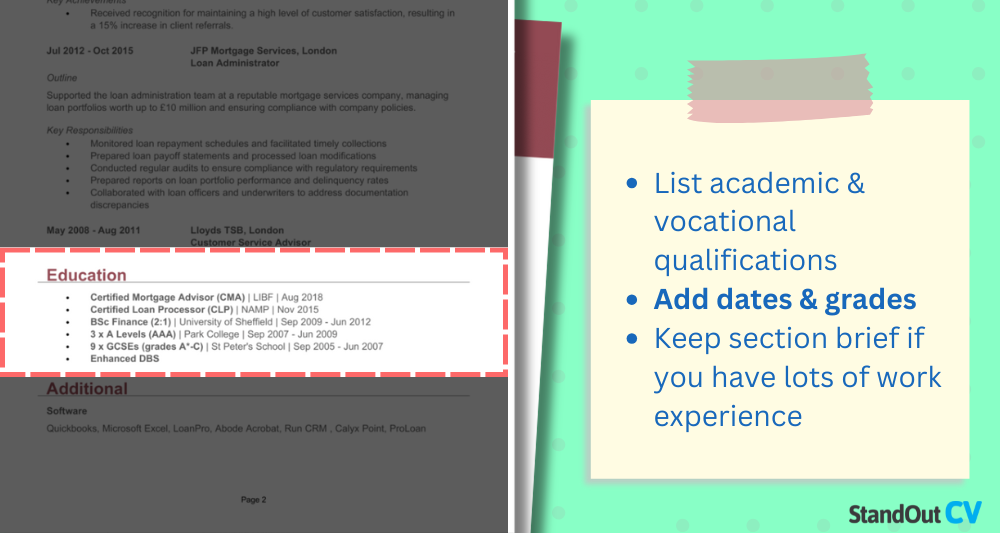

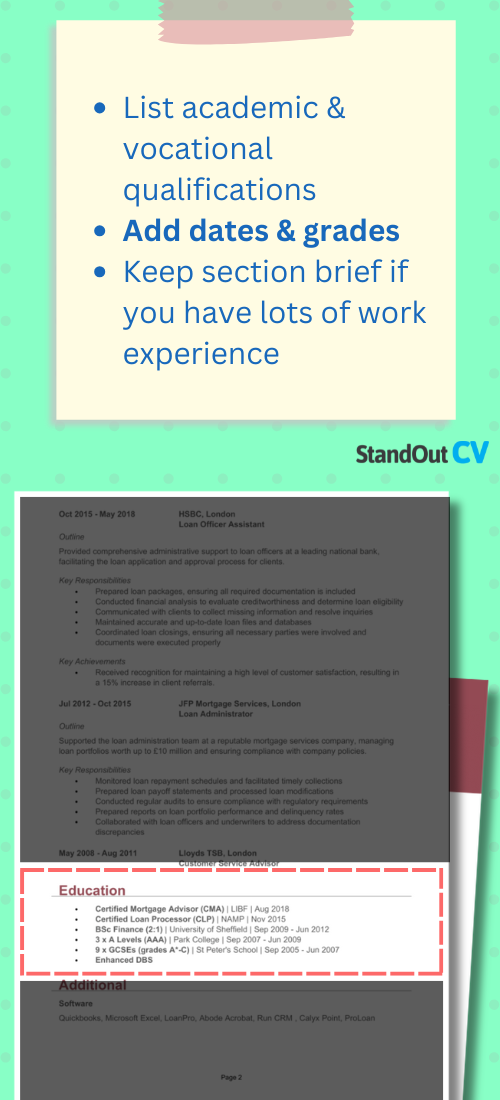

Highlighting your education

As a senior finance professional, your education section matters. Lead with your most recent and relevant qualifications, such as ACA, ACCA, CIMA, or a master’s in finance or accounting. Also include degrees, industry training, and any specialist certifications like IFRS or VAT compliance courses.

Don’t forget to include your membership status and dates where applicable. Keep it factual and tidy – and make sure the focus of your CV stays on your experience.

The best qualifications to boost a Financial Controller CV

- ACCA (Association of Chartered Certified Accountants) – One of the top qualifications for senior finance roles.

- ACA (Institute of Chartered Accountants in England and Wales) – Ideal for technical, audit-heavy roles.

- CIMA (Chartered Institute of Management Accountants) – Excellent for strategic finance roles in business.

- Bachelor’s or Master’s Degree in Finance, Accounting, or Economics – Often required by larger employers.

- IFRS or UK GAAP Training Certification – Adds value in multinational or complex reporting environments.