Do you have a talent for balancing budgets and steering companies toward profitability?

As a Finance Manager, you’re the numbers wizard every company needs. But before you manage their profits, you’ll need to manage a CV that makes recruiters ask, “Where do we sign?!”

This guide, complete with 3 Finance Manager CV examples, will help you create an application that highlights your financial expertise, and gets you plenty of interviews.

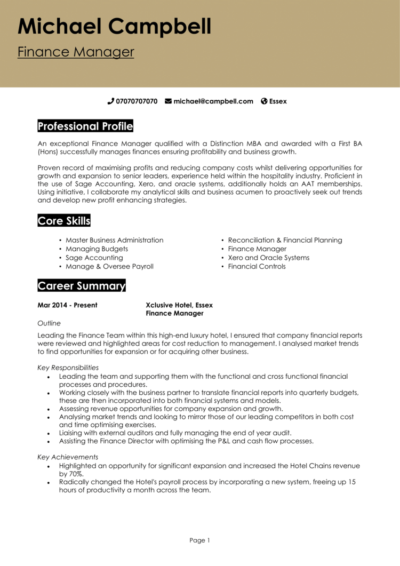

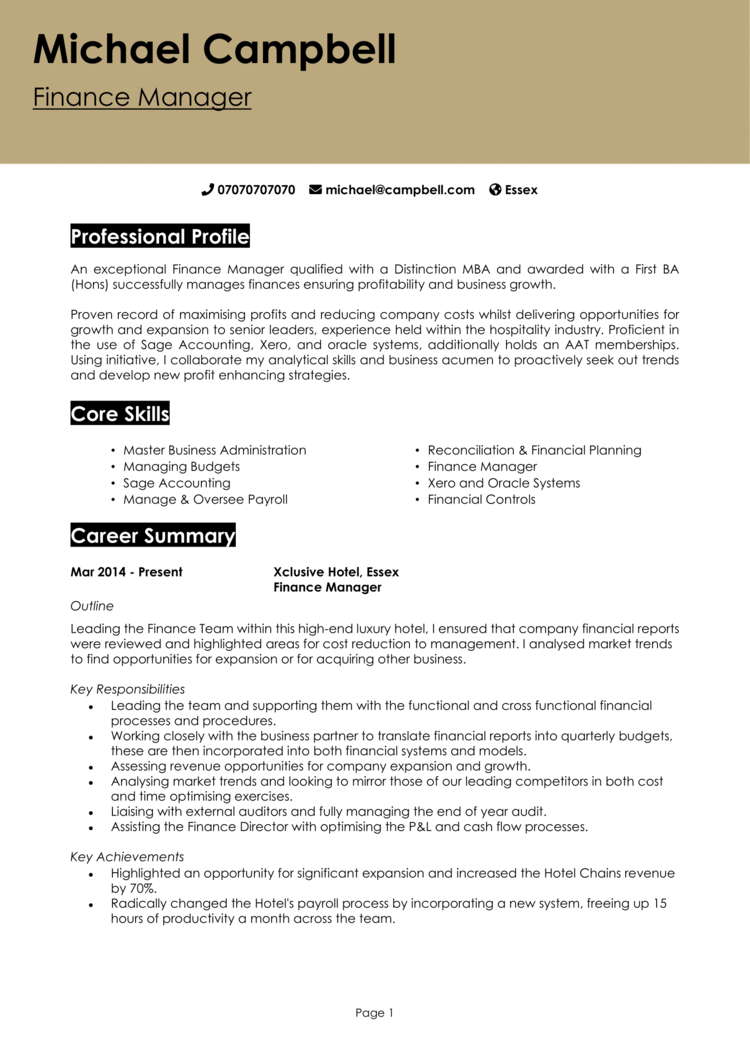

Finance Manager CV

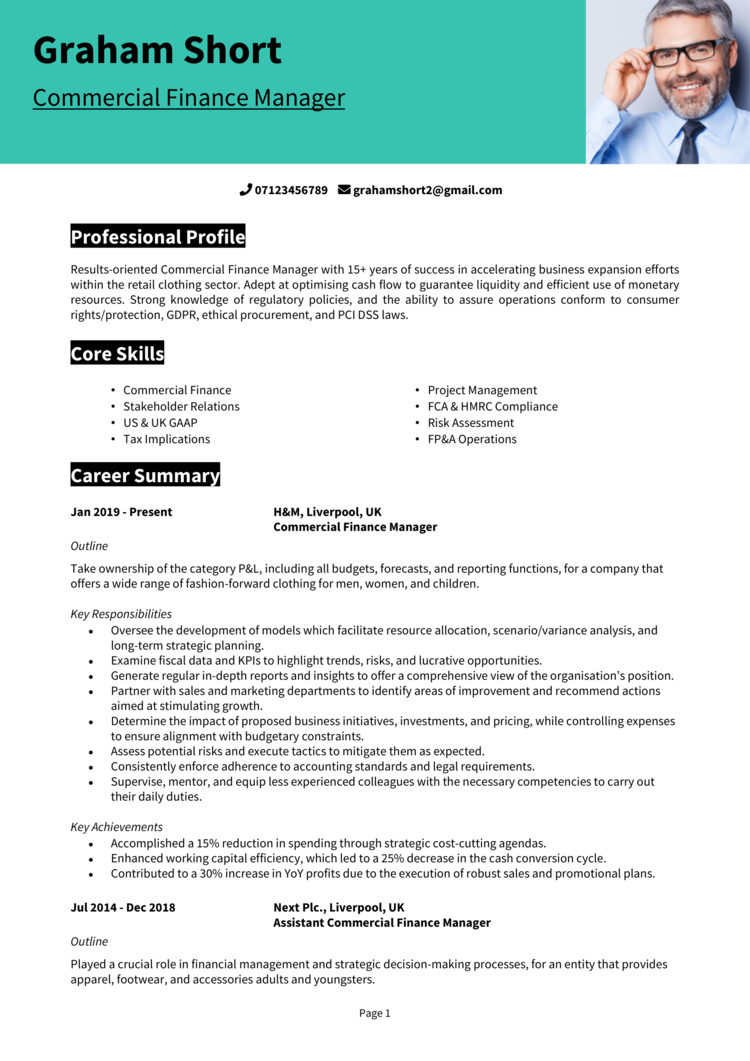

Commercial Finance Manager CV

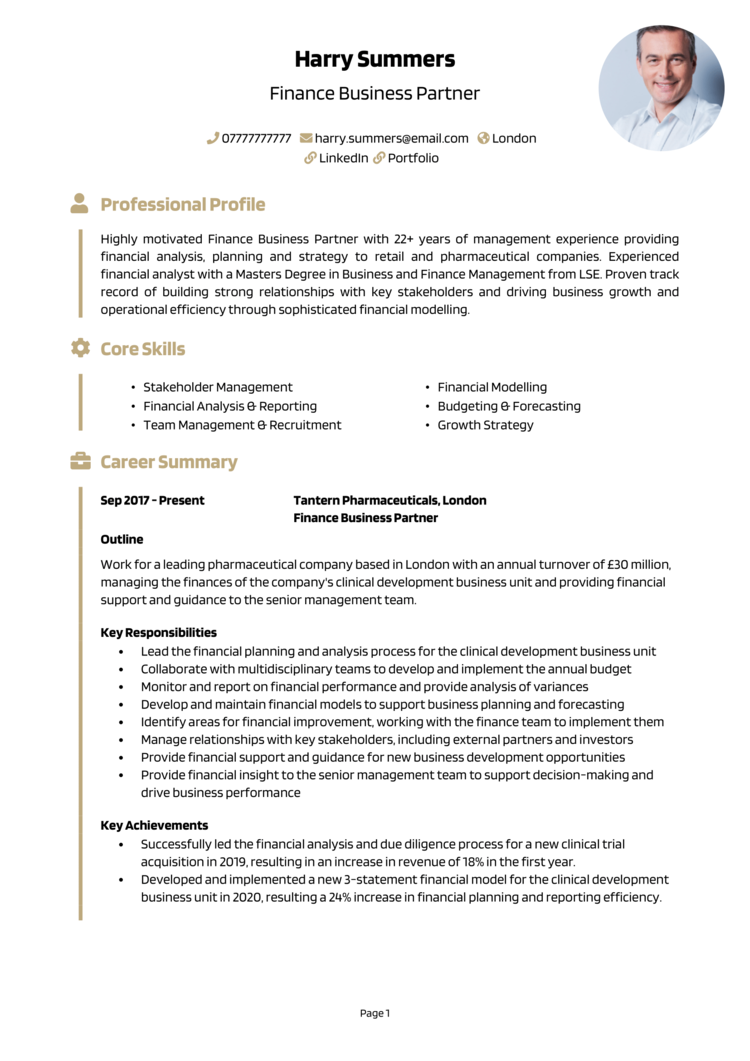

Finance Business Partner CV

How to write your Finance Manager CV

Learn how to create your own interview-winning Finance Manager CV with this simple step-by-step guide.

A Finance Manager CV needs to strike the right balance between professionalism and showcasing your financial expertise. It’s not just about listing qualifications – it’s about proving your ability to manage budgets, guide decision-making, and drive profitability.

These steps will walk you through writing a CV that communicates your financial skills, highlights your strategic achievements, and convinces recruiters you’re the perfect fit for their team.

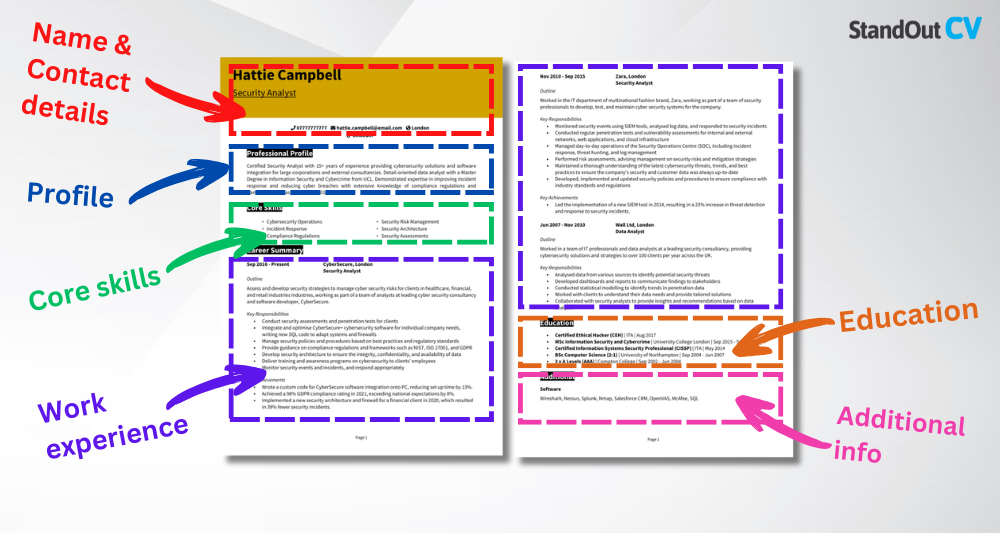

How should you structure your Finance Manager CV?

Your Finance Manager CV should be as organised as the spreadsheets you master. Recruiters don’t want to search for your skills like they’re hidden in an unlabelled spreadsheet tab. Let them quickly see why you’re the right person to manage their finances.

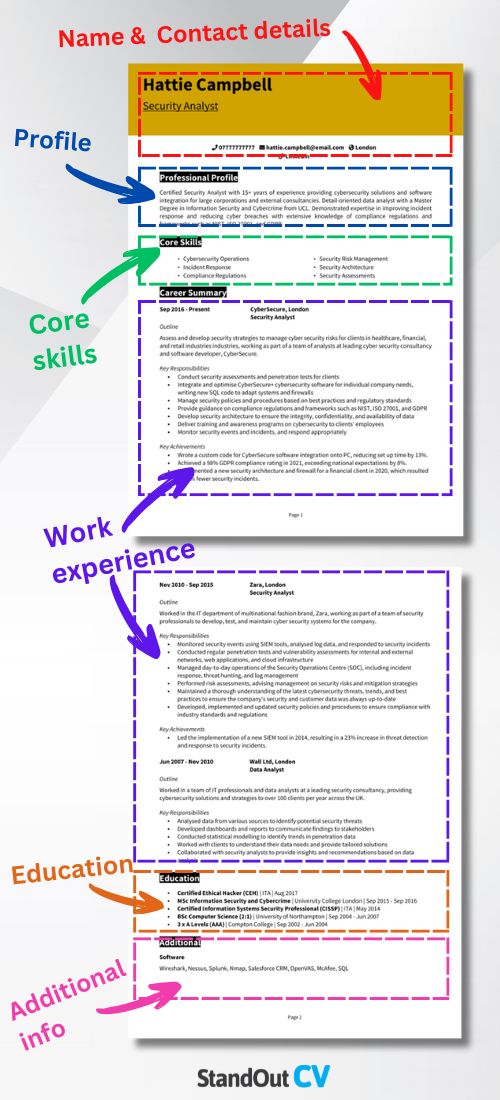

Here’s what the structure of your Finance Manager CV should include:

- Name and contact details – Have your personal details at the very top of your CV, making it easy for potential employers to contact you. A photo is entirely optional and not usually expected for finance roles.

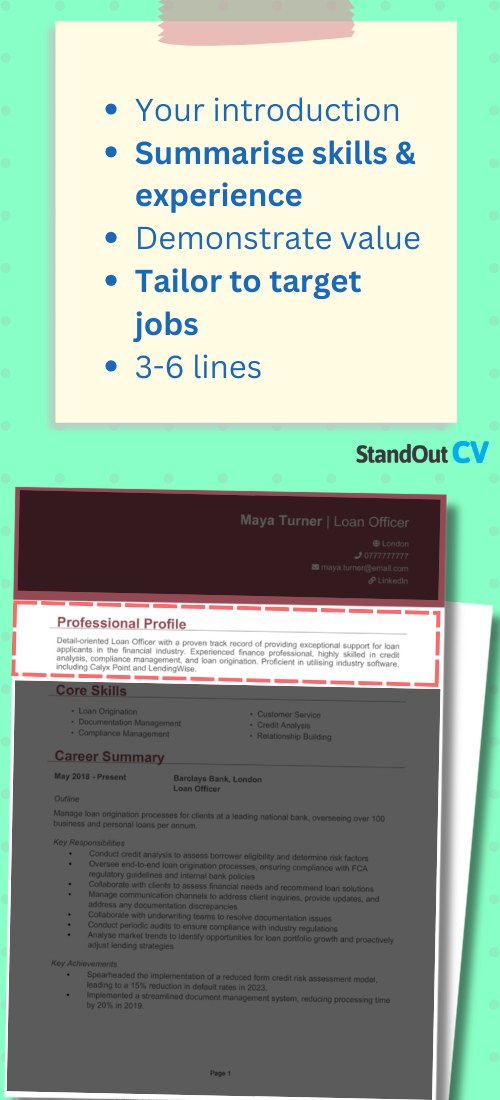

- Profile – Kick things off with a concise summary of your financial expertise, leadership skills, and career highlights – let a company know what benefits you’ll bring them.

- Core skills – Quickly list off your key abilities in financial reporting, budget management, and strategic planning.

- Work experience – Detail your professional history from newest to oldest, focusing on measurable outcomes and responsibilities.

- Education – Show off your academic record, stating your qualifications, professional certifications, and relevant training.

- Additional info – This optional section can include professional memberships, awards, or hobbies and interests that showcase your strategic thinking.

The correct format for a Finance Manager CV

Your CV’s format should be as polished as your quarterly reports – easy to read and free from formatting errors. Even the most impressive qualifications can be overlooked if your CV is poorly presented, so avoid preventable mistakes.

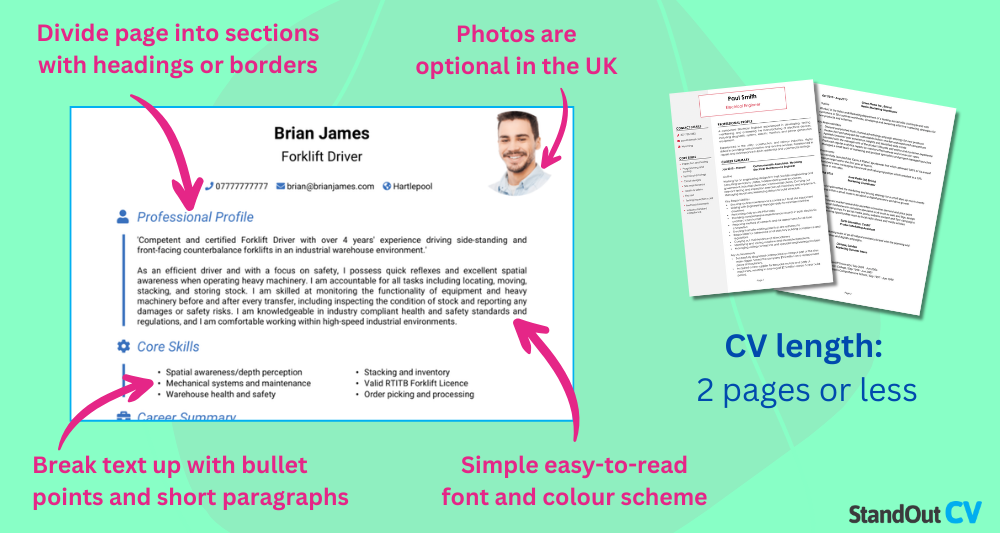

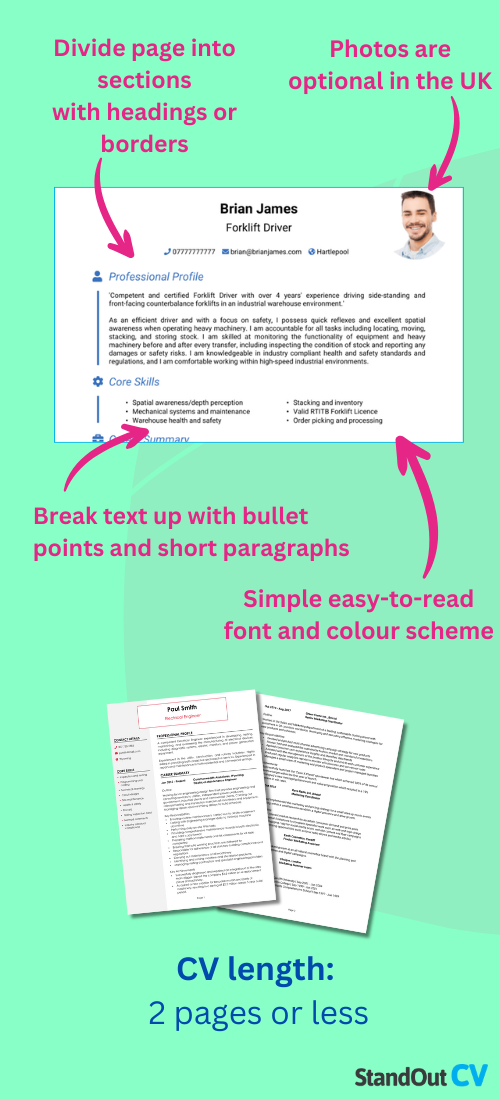

Here’s how to format your Finance Manager CV:

- Bullet points – Use clear, precise statements to present your responsibilities and accomplishments effectively.

- Divide sections – Separate each part of your CV’s layout so the recruiter can find each section with ease.

- Use a clean font – Choose a professional and readable font which ensures your CV looks polished and approachable.

- Keep it the right length – No more than 2 pages, the perfect length to give a thorough overview of your skills and experience without overloading the reader.

Finance Manager CV profile

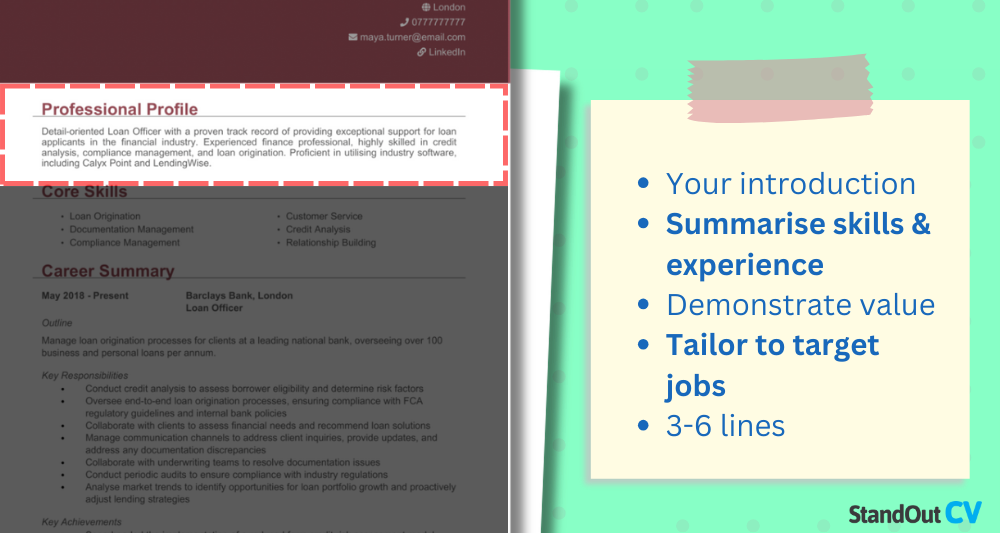

Your CV profile is the opening pitch of your CV, where you give recruiters a quick snapshot of your financial expertise and leadership abilities.

Finance Manager CV profile examples

Profile 1

Strategic Finance Manager with six years of experience in corporate finance, specialising in budgeting, forecasting, and financial reporting. Skilled in using SAP, QuickBooks, and Microsoft Excel to drive data-driven decision-making and improve financial performance.

Profile 2

Organised Finance Manager with four years of experience in retail, focusing on cash flow management, cost control, and implementing financial policies. Adept at managing cross-functional teams and delivering insights that enhance profitability and operational efficiency.

Profile 3

Experienced Finance Manager with over eight years of expertise in manufacturing, specialising in financial planning and analysis, process optimisation, and stakeholder collaboration. Proficient in Oracle, Tableau, and IFRS reporting standards to support strategic growth initiatives.

What to include in your Finance Manager CV profile

Here are some tips to make sure your profile has the precision of a well-balanced ledger:

- Where you’ve worked – Make sure you note which types of industries or organisations you’ve managed finances for.

- Your top qualifications – List degrees like accounting or finance and certifications like ACCA or CIMA.

- Key skills – Include abilities like budget management, financial forecasting, and team leadership.

- Strategic impact – Reference your ability to deliver cost-saving measures or improve financial performance.

- Leadership experience – Mention managing finance teams or collaborating with senior executives.

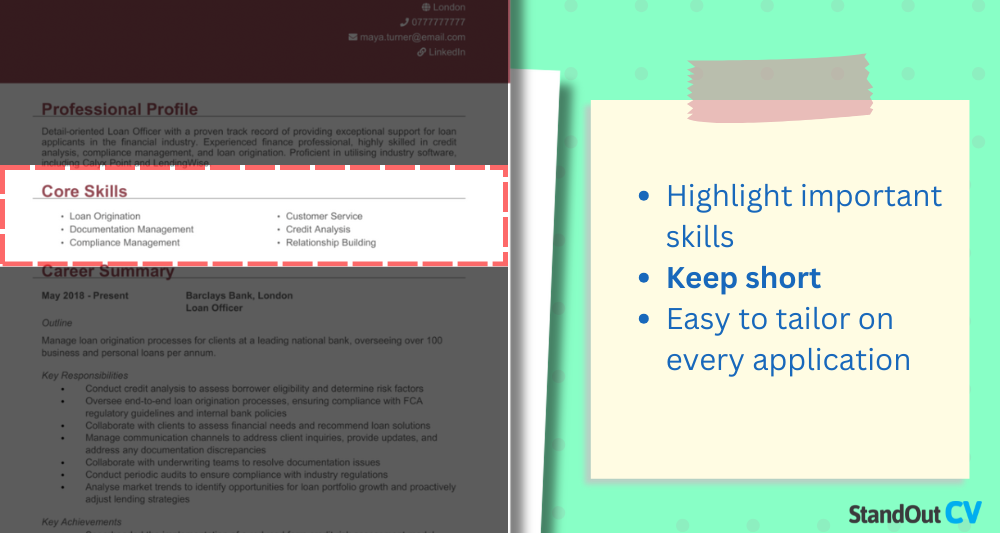

Writing an effective core skills section

Your core skills section is like a financial dashboard – it gives recruiters an at-a-glance view of your most important features.

For Finance Managers, this section should highlight both technical expertise and leadership capabilities. Tailor these skills to the job description to ensure alignment with the employer’s needs.

Top skills for your Finance Manager CV

- Financial Reporting – Preparing accurate financial statements and reports for stakeholders.

- Budget Management – Overseeing budgets to ensure financial stability and resource optimisation.

- Strategic Planning – Aligning financial strategies with organisational goals.

- Cost Analysis – Identifying opportunities for cost reduction and efficiency improvements.

- Tax Compliance – Ensuring adherence to tax laws and regulations.

- Risk Management – Mitigating financial risks through careful analysis and planning.

- Forecasting – Predicting financial trends to support decision-making.

- ERP Systems – Proficient in tools like SAP, Oracle, or Microsoft Dynamics for financial management.

- Team Leadership – Managing and mentoring finance teams to achieve organisational objectives.

- Stakeholder Collaboration – Working with executives to inform and support strategic decisions.

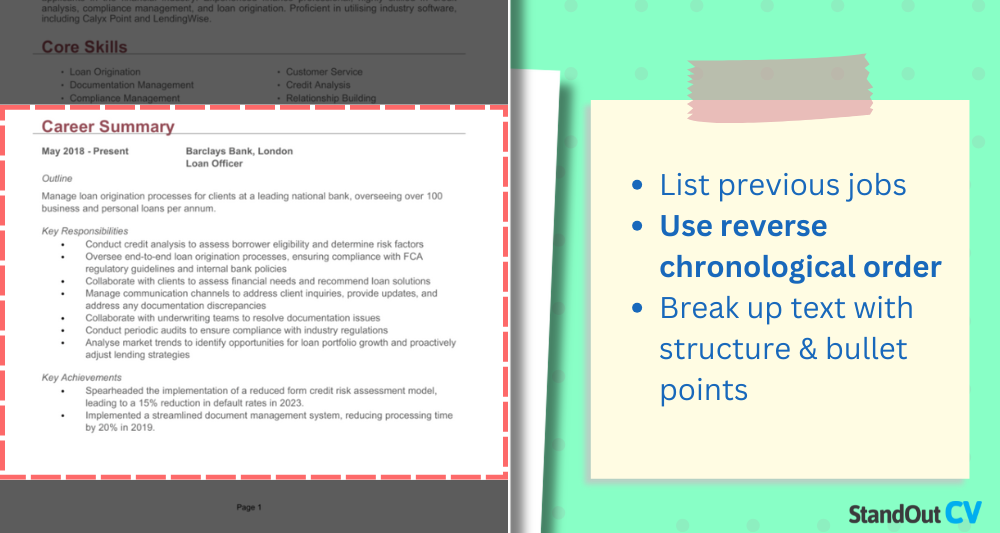

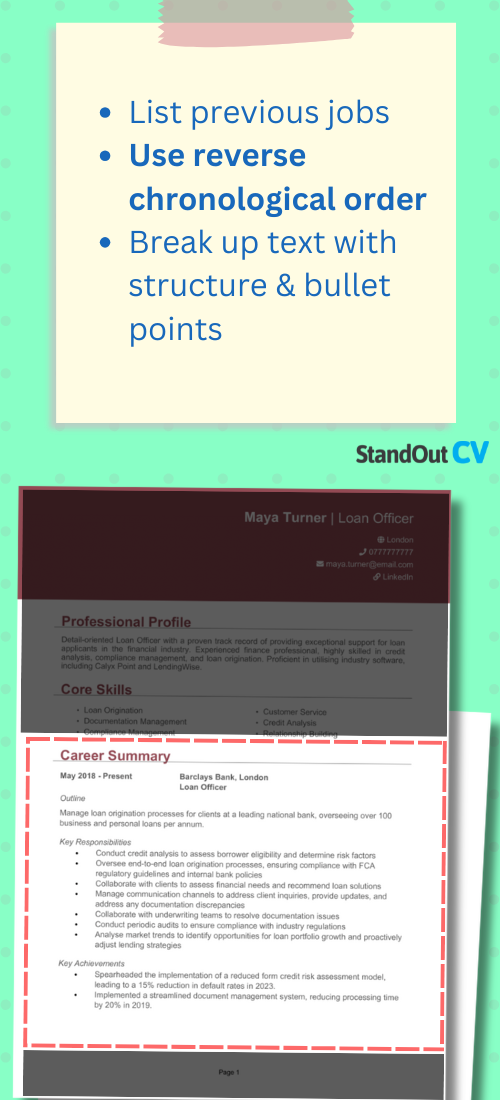

Describing your work experience

Your work experience section is where you show how you’ve turned numbers into results and budgets into business success. Highlight your achievements, responsibilities, and the measurable impact of your work.

List your roles in reverse chronological order, focusing on key contributions and results.

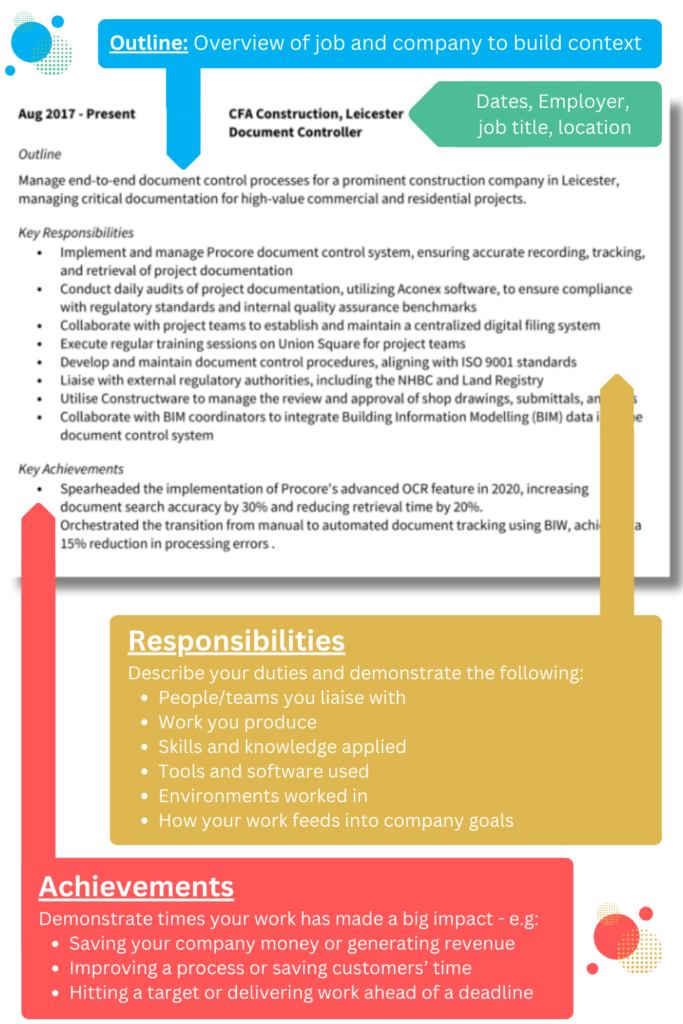

How should you list jobs on your Finance Manager CV?

- Outline – Provide an overview of the organisation, your role, and the financial areas you managed.

- Responsibilities – Highlight tasks like financial reporting, budget oversight, or leading audits. Use action verbs like “analysed,” “developed,” or “implemented.”

- Achievements – Showcase measurable results, such as cost savings, increased revenue, or successful financial strategies. Include figures wherever possible to add impact.

Example jobs for Finance Manager

Finance Supervisor | ProCorp Solutions

Outline

Led the financial operations for a mid-sized technology company, focusing on strategic planning, financial analysis, and compliance. Delivered insights to drive sustainable growth and profitability.

Responsibilities

- Prepared and monitored budgets exceeding £10M, ensuring alignment with company goals.

- Developed financial forecasts and presented data-driven recommendations to senior management.

- Reviewed and optimised financial processes to enhance operational efficiency.

- Managed accounts payable and receivable, ensuring timely reconciliations.

- Collaborated with external auditors to ensure regulatory compliance and accurate reporting.

Achievements

- Increased operational efficiency by 20 percent through process automation.

- Reduced costs by £500K annually by identifying and eliminating wasteful expenditures.

- Recognised by leadership for delivering a 15 percent improvement in net profit margins.

Finance Manager | Retail Dynamics Ltd

Outline

Oversaw the financial health of a national retail chain, focusing on cash flow management, budget planning, and cost control. Provided actionable insights to optimise profitability across multiple locations.

Responsibilities

- Prepared and analysed monthly, quarterly, and annual financial statements.

- Implemented cost-saving measures that reduced overhead expenses by 10 percent.

- Monitored cash flow to ensure adequate liquidity for daily operations.

- Led the rollout of a new financial management system to improve reporting accuracy.

- Supervised a team of five finance professionals, fostering skill development and collaboration.

Achievements

- Boosted revenue by 8 percent through enhanced financial forecasting.

- Reduced reporting errors by 25 percent with the adoption of a streamlined process.

- Delivered a comprehensive financial strategy that increased cash reserves by £1M.

Finance Manager | Global Manufacturers Corp

Outline

Managed financial operations for a multinational manufacturing company, focusing on financial planning, compliance, and performance monitoring. Delivered strategic support to senior leadership for long-term growth.

Responsibilities

- Developed and implemented robust financial planning and analysis processes.

- Prepared detailed variance analyses to monitor financial performance against budgets.

- Ensured compliance with IFRS and local regulatory requirements across all regions.

- Managed financial risk assessments to identify and mitigate potential challenges.

- Collaborated with cross-functional teams to align financial strategies with business objectives.

Achievements

- Achieved a 10 percent reduction in operational costs through process optimisation.

- Increased reporting accuracy by 30 percent with the implementation of Oracle ERP.

- Successfully supported a £50M expansion project by securing necessary funding.

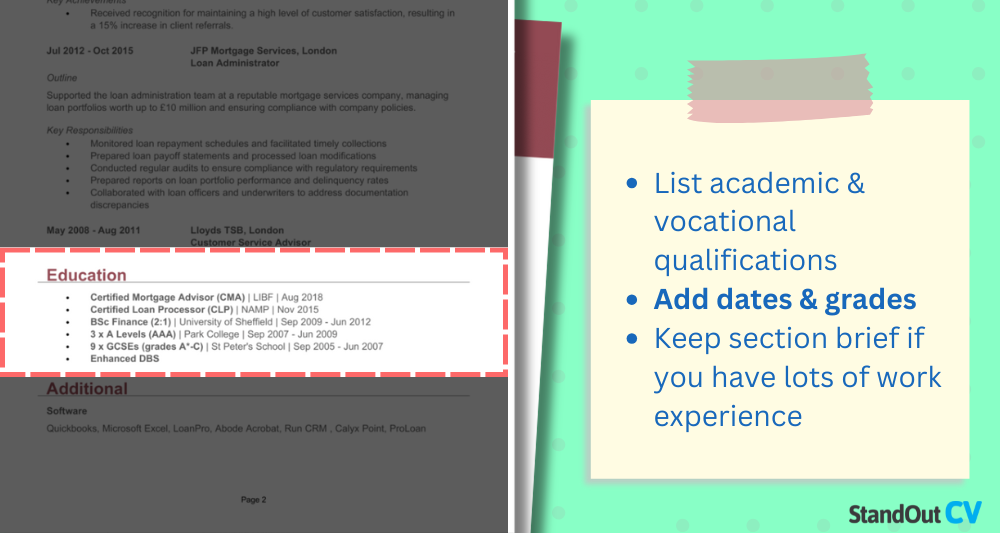

Education section

The education section is essential for Finance Managers, as it demonstrates your foundational knowledge and professional development. Include degrees, certifications, and any relevant courses.

List your qualifications in reverse chronological order, starting with the most recent.

Best qualifications for Finance Managers

- Chartered Accountant (CA) – Recognised certification for advanced accounting and financial expertise.

- Certified Management Accountant (CMA) – Expertise in management accounting and strategic decision-making.

- Association of Chartered Certified Accountants (ACCA) – Professional qualification for accounting and finance.

- Master’s Degree in Finance or Accounting – Advanced academic training in financial principles and practices.Diploma in Risk Management – Certification in identifying and mitigating financial risks.